Construction Industry in Spain - Extreme Increase of Mergers and Acquisitions Due to Market Adjustment

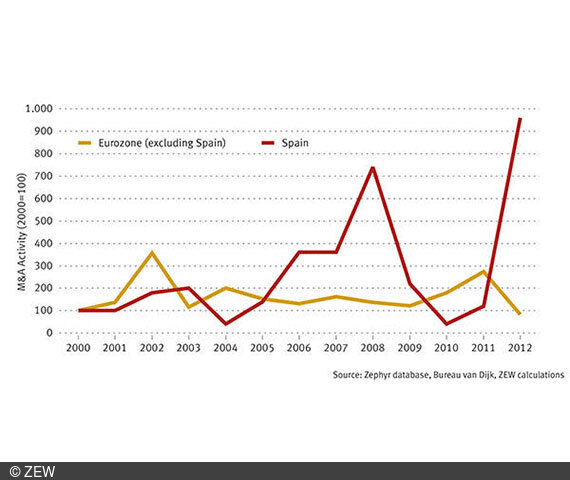

ResearchThere are currently only few mergers and acquisitions in the construction sector within the Eurozone. Spain, however, is the exception to the rule. An extreme increase of M&A activities as of the beginning of 2012 can be observed in the country. 48 mergers and acquisitions have already been counted within the first six months of the current year. This is eight times the number of transactions counted in all of 2011. This dynamics is likely to continue until the end of the year and also into the next year. This is the result of an analysis conducted by the Centre for European Economic Research (ZEW) on the basis of Bureau van Dijk's Zephyr database, which contains information on worldwide mergers and acquisitions, stock market launches, and private equity transactions.

Before the Spanish housing bubble burst in 2008, the construction sector had accounted for 12 per cent of GDP and, as a consequence, had been one of the most important economic sectors in Spain. Until the end of 2011 the value added generated in this sector, adjusted for price changes, decreased by nearly one third. The financial crisis put a sudden end to the building boom in Spain in 2008 and resulted in an unprecedented market adjustment of the country's construction sector. Between 2008 and 2010 inclusive, some 4,400 companies of the Spanish construction sector, which is characterised by small firms, became insolvent. In 2011 1,914 insolvencies were added. In the wake of this "dying" of companies, the first peak level concerning mergers and acquisitions was reached in 2008. Due to the sharp decline of the Spanish economy in 2009 – the real GDP dropped by 3.7 per cent – M&A activities have come to a standstill. Now, a second wave of mergers and acquisitions seems to be in the offing. During the first half of this year alone, 48 mergers and acquisitions were counted. This is eight times as much as during all of 2011. This trend is likely to continue, since some 100 transactions were announced in 2011 which might be concluded in 2013 or 2014. The Spanish construction sector is characterised by many small and only few large firms nearly all of which are Spanish-owned. The majority of transactions thus involve only Spanish companies.

For further information please contact

Ulrich Laitenberger, Phone +49 621/1235-185, E-mail laitenberger@zew.de