ZEW PwC China Economic Barometer - German Managers Continue to Feel Welcome in China

ResearchChina continues to be an attractive investment location for German companies. According to a special question raised in the light of recent events, just under three quarters of senior executives (74 per cent) say that there has been no change in the quality of their company's business relations in China since the previous year. Eleven per cent report improved conditions while 16 per cent of decision-makers feel less welcome in the country compared with the previous year. These are the central findings of the ZEW PwC China Economic Barometer survey in the fourth quarter of 2014.

Some managers believe competition law places foreign companies at a disadvantage

All is not sunshine and roses, though. 18 per cent of participants strongly agreed (34 per cent rather agreed) with the statement that foreign companies are being targeted for litigation under competition law and subjected to accusations of corruption in order to create competitive advantages for domestic companies. Only eight per cent of participants disagreed (seegraph below). At the same time, virtually none of the surveyed managers felt that foreign companies commit more violations of competition law than their Chinese competitors. However, since no statistics are published on this issue, the participants in the survey were only able to make assumptions. "The findings of the survey show that, in the view of many German companies working in China, more comprehensive public reporting by the Chinese authorities would be desirable, and not just on this point.Because action by the government in this area could also strengthen people’s confidence in the rule of law", comments Jens-Peter Otto, partner and China expert at PwC. "Although it has to be said that the Chinese authorities are also taking action against their domestic companies."

Mildly positive assessment of the economic climate

Executives saw a slight improvement in China's current economic situation compared with the previous quarter. The aggregate score obtained by adding weighted positive and negative responses has increased to 16.7 points. However, the figure was 33.3 points just one year ago.

Optimism about the economy continues to decline

Reflecting the gloom over the current situation that has been growing in the past months, economic expectations for the coming twelve months are increasingly reserved. While in the fourth quarter of 2013 senior executives felt that the business situation was likely to improve notably over the following twelve months, this figure has since then dropped to around 20 per cent. The surveyed executives now feel that the likelihood of a significant deterioration in the economy has more than doubled, increasing from eleven to 26 per cent (seegraph). "The economy in China has been less dynamic than our experts expected in the previous year. This is definitely one factor driving the more cautious statements on prospects for the coming year", comments Dr. Oliver Lerbs, economist at ZEW's "International Finance and Financial Management" Research Department.Yet another confirmation of the decline in optimism is the fact that the majority of senior executives expect foreign direct investment in China to fall over the next few months.

Trading prospects for German companies in China not yet affected

Despite lower economic expectations, the majority of senior executives assume that trade between German companies and the world's second-largest economy will continue to grow. But here too there is some gloom: while the aggregate score of optimistic and pessimistic ratings on this subject was just less than 60 points only one year ago, it has now dropped from 35.9 points in the third quarter to 29.2 points in the fourth quarter.

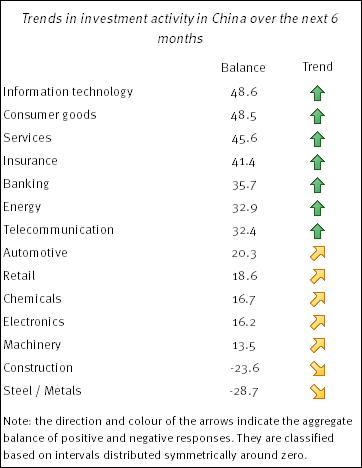

Sectoral investment remains stable

Sentiment has barely changed since the previous quarter with respect to expectations of investment performance in key sectors. Whilst gross investment by companies in the construction industry and the steel and metal sector will continue to decline, the majority of managers expect strong or even very strong increases in investment activity in seven economic sectors. The information technology sector is the front runner for the third time in five quarters.

The survey for the ZEW PwC China Economic Barometer in the fourth quarter of 2014 was conducted between October 10 and October 29, 2014. Thirty-nine senior executives from German companies in China took part.

For more information please contact

Dr.Oliver Lerbs, Phone +49621/1235-147, E-mail lerbs@zew.de

Prof. Dr. Michael Schroeder, +49621/1235-140, E-mail schroeder@zew.de