Eurozone Economy Expected to Recover

Business Cycle Tableaus by ZEW and Börsen-ZeitungEurozone Growth Forecasts for 2024 & 2025 Significantly Exceed Those for Germany

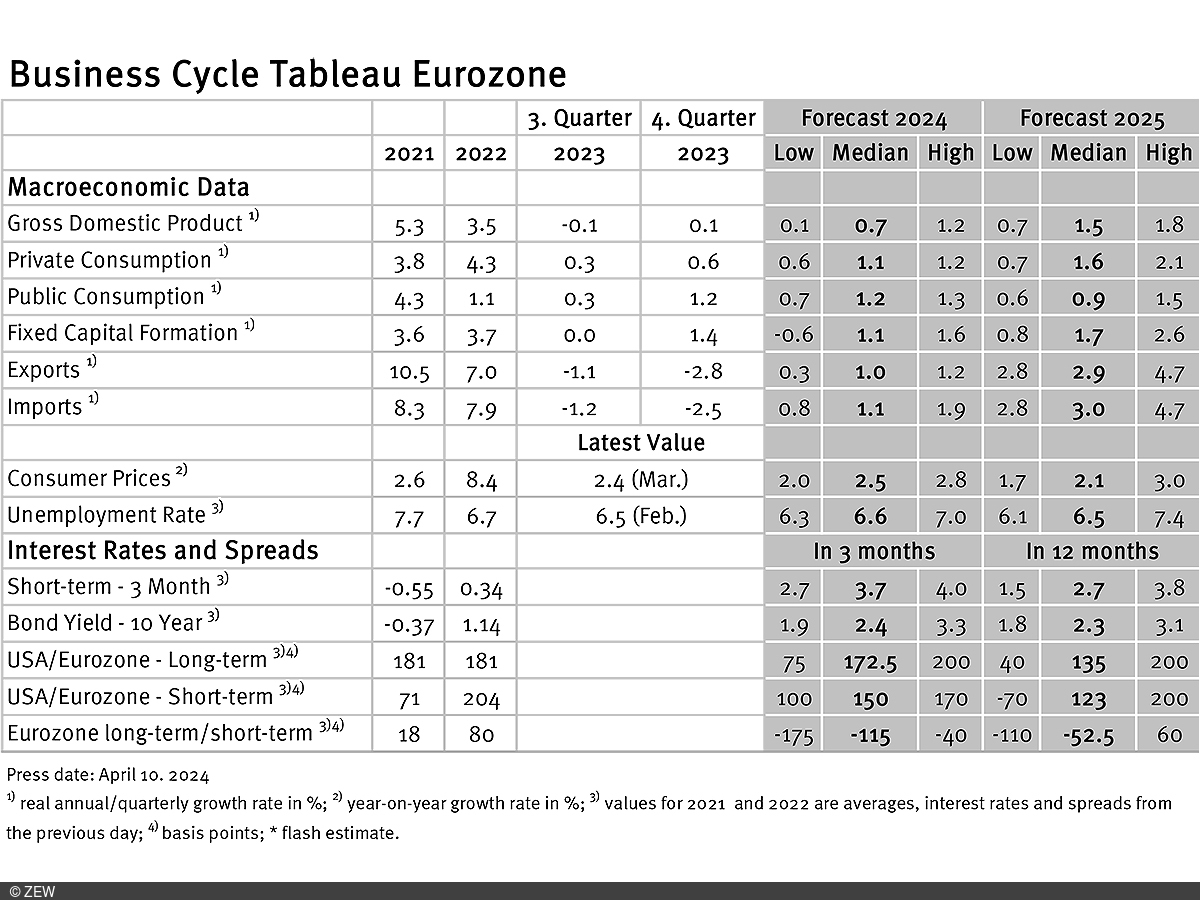

Business cycle experts expect to see an economic recovery in the eurozone in 2024 and especially in 2025. At the same time, inflation rates show a downward trend. In contrast, Germany is seeing negative trends in quarterly growth figures, with pessimistic forecasts for 2024. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

The quarterly growth figures for the real GDP in the eurozone remain unchanged at minus 0.3 per cent for the third quarter of 2023 and at 0.1 per cent for the fourth quarter of 2023. For 2024, experts now predict a GDP increase of 0.7 per cent, slightly above the March value (up by 0.1 percentage points). However, the range of individual growth expectations remains at 1.1 percentage points. In line with the March projections, GDP growth is expected to reach 1.5 per cent in 2025, with the range narrowing by 0.4 percentage points to 1.1 percentage points. Thus, there is a relative consensus among experts regarding economic growth in 2024 and 2025. As in the previous months, European foreign trade is viewed as the main driver of the economic recovery in 2025, with growth expectations for imports and exports rising by 0.1 percentage points each, reaching 2.9 per cent and 3.0 per cent, respectively.

Projections for Germany remain unchanged

The quarterly growth figures for Germany show a decline of 0.1 per cent in the third quarter of 2023 and of 0.3 per cent in the fourth quarter of 2023. Forecasts for 2024 have become more pessimistic, with experts revising their growth expectations downward by 0.2 percentage points to 0.1 per cent. Accordingly, the German economy is expected to largely stagnate this year and continue to lag behind the rest of the eurozone. However, economic growth expectations for 2025 remain stable at 1.2 per cent. Expectation ranges for 2024 and 2025 are the same as in March and slightly higher than the corresponding values for the eurozone, at 1.3 and 1.2 percentage points, respectively.

Inflation rates in the eurozone and in Germany continue to dip

Meanwhile, the downward trend in inflation rates in the eurozone and Germany continues. Specifically, the preliminary inflation rates stand at 2.4 per cent for the eurozone and 2.2 per cent for Germany, down 0.2 and 0.3 percentage points, respectively, from March. For the entire year 2024, inflation rates of 2.5 per cent (eurozone; up 0.1 percentage points from March) and 2.6 per cent (Germany; unchanged from March) are expected. Compared to the growth forecasts, however, the range of inflation expectations suggests broad consensus among the experts, with values of 0.8 (euro area) and 1.0 (Germany) percentage points. Looking ahead to 2025, inflation rates of 2.2 per cent (eurozone) and 2.1 per cent (Germany) are forecast, with slightly higher levels of disagreement among experts, as indicated by ranges of 1.3 (eurozone) and 1.2 (Germany) percentage points.

Short-term interest rate expectations on the rise

Expectations for short-term interest rates (three months) have increased by 0.3 percentage points to a new value of 3.7 points, aligning with market expectations for an ECB rate cut in June. However, the range of expectations, at 1.3 percentage points, is relatively high given the short forecast horizon. Expectations for short-term interest rates a year ahead are only slightly lower, at 2.7 points, down by 0.1 percentage points compared to March.

Business Cycle Tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, the expenditure breakdown, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate differentials (IDRs). The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutions.