Scepticism despite Slight Rebound of the German Economy

Business Cycle Tableaus by ZEW and Börsen-ZeitungExperts Not Adjusting Forecasts Upwards for the Time Being

Despite positive economic growth in the first quarter of 2024, experts are not currently expecting the German economy to begin recovering more quickly. A more comprehensive recovery is forecast for 2025 at the earliest. The situation in the wider eurozone is similar. Signs of economic recovery are increasing, but a stronger growth period is not expected to occur until 2025. In both regions, inflation rates are only stabilising to a small degree. According to experts, interest rate hikes are still expected to occur this year. This points to a slow but steady improvement. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

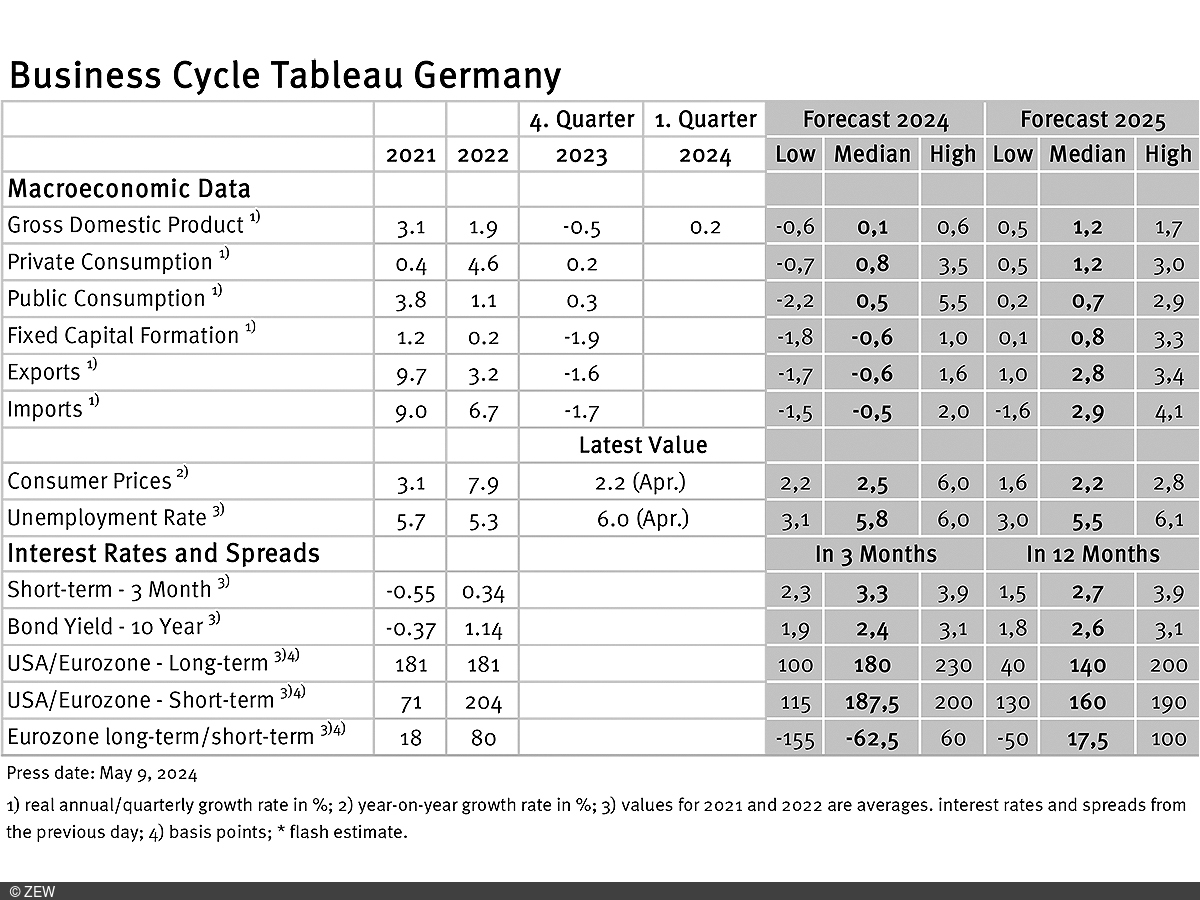

The German economy can breathe a sigh of relief. After the quarterly growth figures for real GDP in Germany were still at minus 0.5 per cent in the fourth quarter of 2023, the German economy grew somewhat surprisingly in the first quarter of 2024 at a rate of 0.2 per cent compared to the previous month. The danger of a prolonged recession seems to have been averted for now. This good news is not yet reflected in experts’ forecasts, however. For the current year, they predict a 0.1 per cent increase in German GDP. Therefore, the prediction for 2024 remains unchanged since April. The range of individual growth prospects fell slightly by 0.1 percentage points to a value of 1.2 percentage points. The 2025 growth forecast holds steady at 1.2 per cent, still remaining above the projection for 2024. However, when assessing the small changes in growth expectations, it should be noted that the current GDP figures were only published shortly before the editorial deadline (on 30 April) and the majority of experts had already published their growth forecasts at that time.

Economic rebound in the eurozone

Quarterly growth in the eurozone was registered as 0.1 per cent in the fourth quarter of 2023 and 0.3 per cent in the first quarter of 2024. Thus, there are increasing indications of economic recovery throughout the whole eurozone. Similar to Germany, growth prospects remain unchanged for 2024. Experts are predicting economic output in the eurozone to grow by 0.7 per cent. The economic growth expectation for 2025 remains at 1.5 per cent. Accordingly, the prediction remains that economic recovery in Germany will be somewhat slower than in the rest of the eurozone.

Inflation remains stable

Inflation rates in Germany and the eurozone appear to be stabilising at a low level. Inflation rates in April were 2.2 per cent for Germany and 2.4 per cent for the eurozone. Neither figure has changed since the previous month. For 2024 as a whole, average inflation is expected to lie at 2.5 per cent for Germany and 2.4 per cent for the eurozone. In both cases, the expectations are therefore 0.1 percentage points below the values from April and very close to the currently observed inflation rates. The forecast inflation rates for 2025 have also not changed and are given as 2.2 per cent for Germany and 2.1 per cent for the eurozone. The minor changes in inflation expectations reinforce the impression that inflation rates are increasingly stabilising.

Interest rate hikes expected before the end of the year

The experts have significantly revised their monetary policy expectations for the next three months. Expectations for short-term interest rates have fallen by 0.4 percentage points to a new value of 3.3 points, compared to April. Thus, experts appear to be expecting several interest rate hikes in the current year. By contrast, the expectation for 2025 remains unchanged at 2.7 points. Further interest rate cuts are therefore forecast for the coming year.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the Eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is extracted from these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current forecasts for the GDP, the expenditure breakdown, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate differentials (IDRs). The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutions.