Economic Growth Remains Distant on the Horizon

Business Cycle Tableaus by ZEW and Börsen-ZeitungAnnual Outlook of Economic Experts Deteriorates for Germany

Economic experts are once again more pessimistic about the development of the German economy. According to their current forecast, Germany is set to conclude the year in a state of recession, while the eurozone as a whole is expected to fare considerably better. However, the German economy is projected to rebound and catch up with the eurozone’s growth in the following year. Inflation is also expected to ease off by 2024. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

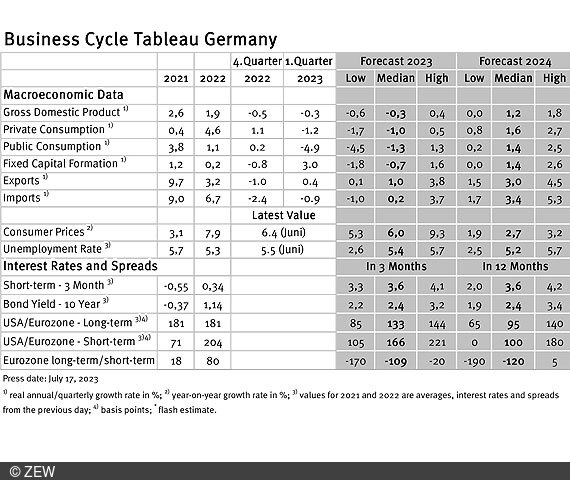

After the quarterly growth figures for Germany’s real gross domestic product (GDP) were revised downwards to -0.3 per cent last month, economic experts are now adjusting also their forecasts. The latest projection foresees a 0.3 per cent decline in Germany’s real GDP for the entire year of 2023, compared to the previous month’s expectation of zero growth. Looking ahead to 2024, the outlook has been revised slightly downward from 1.3 per cent to 1.2 per cent.

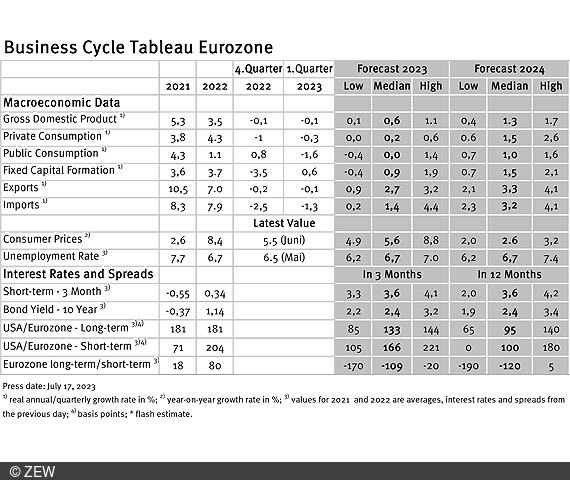

The eurozone is facing similar challenges as growth figures have been adjusted downward as well. Eurostat reveals that both the fourth quarter of 2022 and the first quarter of 2023 saw a 0.1 per cent contraction in real GDP compared to the previous quarter, contrary to the initial expectation of a slight increase. Consequently, based on these updated numbers, the eurozone has entered a mild recession since the first quarter of this year.

Germany trails behind in the eurozone

Germany’s economic performance in the eurozone continues to fall short compared to other euro members. In the first quarter of 2023, Germany ranked a disappointing 15th out of the 20 member countries in terms of real GDP growth. While 13 euro countries experienced positive growth during this period, seven saw a decline. Economic experts predict that, with a projected growth rate of 0.6 per cent for this year, the eurozone as a whole will outperform Germany. Looking ahead to the next year, the forecasts are nearly identical, with 1.3 per cent for the eurozone and 1.2 per cent for Germany.

Inflation in 2024 nears ECB target

In terms of inflation, the outlook for the eurozone is also more favourable than for Germany. In June, inflation stood at 6.4 per cent for Germany and 5.5 per cent for the eurozone. For the entire year, average inflation is expected to be around 6.0 per cent for Germany and 5.6 per cent for the eurozone. Moving into 2024, experts foresee a more significant decline in inflation for the eurozone to 2.6 per cent, nearing the European Central Bank’s target. The projection for Germany remains only slightly higher at 2.7 per cent.

No easing of monetary policy

Monetary policy is not expected to relax in the near future, nor will there be an increase in short-term interest rates. Long-term interest rates are anticipated to remain well below the 3-month rates in the coming year. This resulting strongly inverted yield curve aligns with the projected weak economic growth in the eurozone until the end of 2024 and serves as a longer-term indicator of economic conditions.

Business Cycle Tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.