Cautious Forecasts despite Modest Recovery in the Eurozone

Business Cycle Tableaus by ZEW and Börsen-ZeitungOngoing Uncertainty Dampens Expectations for 2024

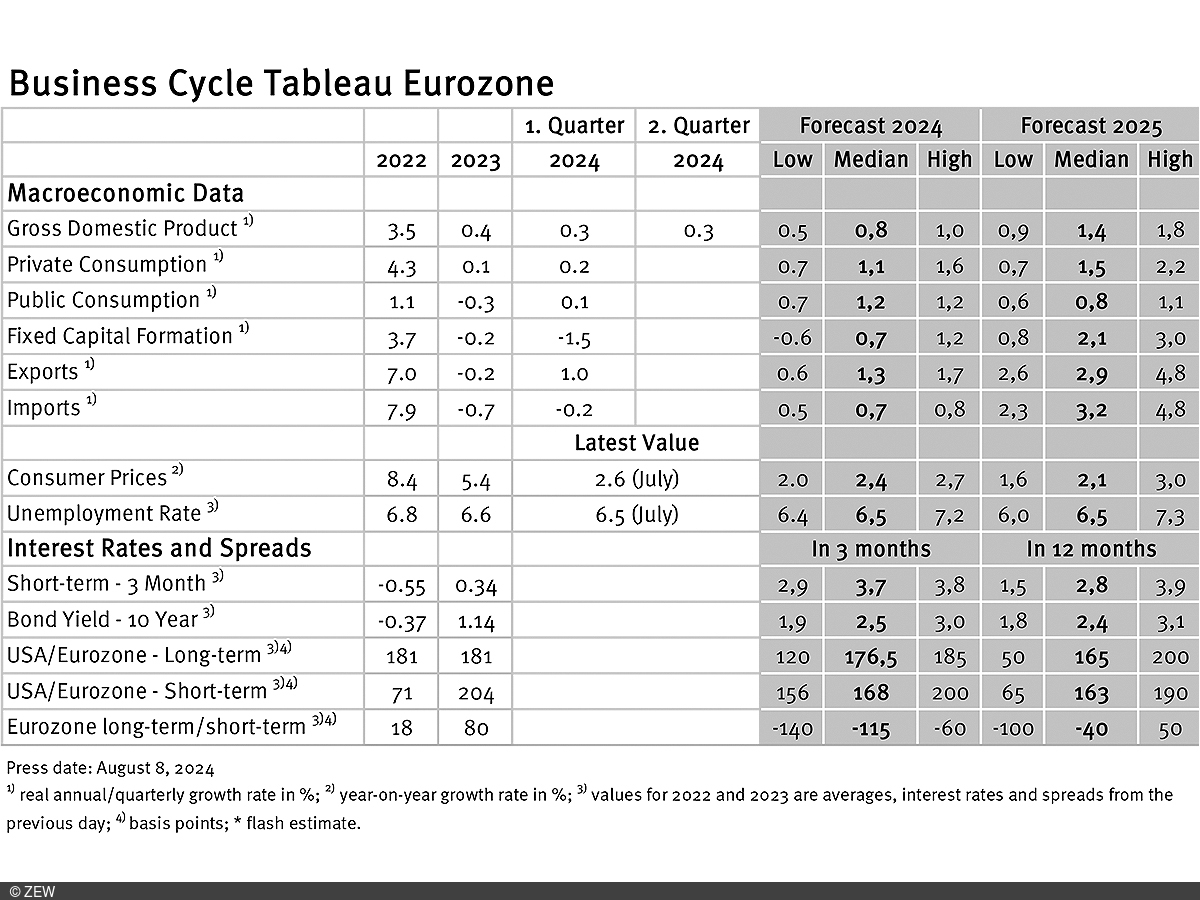

Despite signs of an economic recovery in the eurozone during the first half of 2024, economic experts are not adjusting their GDP forecasts. The slight revision of growth expectations might be influenced by the slightly rising inflation rate, which could indicate ongoing inflationary pressures. Due to the unclear trajectory of inflation, the ECB remains hesitant about further interest rate hikes, a sentiment echoed in the stagnant interest rate expectations. In Germany, the decline in GDP growth in the second quarter of 2024 has heightened concerns about a potential recession. Nevertheless, growth expectations for 2024 remain largely unchanged, though uncertainty among experts has significantly increased. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

Real GDP in the eurozone grew by 0.3 per cent in both the first and second quarters of 2024, adding to the signs of an economic recovery. However, this development is not yet reflected in the experts’ GDP forecasts. As in the previous month, they continue to predict a GDP growth rate of 0.8 per cent for 2024. The range of individual growth expectations has narrowed to 0.5 percentage points, indicating a growing consensus among the experts. In 2025, GDP growth is expected to reach 1.4 per cent, 0.1 percentage points lower than in July. The range of forecasts remains at 0.9 percentage points. Factors such as the potential escalation of the conflict in the Middle East, unexpectedly weak US labour market data and the uncertain outcome of the US presidential election could prevent growth expectations for the eurozone from rising further.

July sees inflation rates increase

Another possible explanation for the limited change in growth expectations, despite positive economic signals, could be the development of inflation rates. In July, inflation rates rose slightly in both the eurozone and Germany. More specifically, the preliminary inflation rates for July were 2.6 per cent in the eurozone and 2.3 per cent in Germany, both up 0.1 percentage points from June. This marks the second increase in eurozone inflation in the past three months, potentially indicating that inflationary pressures are continuing. However, the experts still expect inflation rates of 2.4 per cent for the whole of 2024 in both the eurozone and Germany. The ranges of inflation expectations for 2024 also remain unchanged at 0.7 percentage points for the eurozone and 0.6 percentage points for Germany, indicating a high degree of consensus among the experts. The inflation rates forecast for 2025 are 2.1 per cent for the eurozone (unchanged from July) and 2.2 per cent for Germany (up 0.1 percentage points from July), with ranges of 1.4 percentage points in both cases.

Uncertainty over future interest rate moves

The unclear inflation outlook in the eurozone is one of the main reasons for the ECB’s reluctance to raise interest rates further. As a result, the experts’ interest rate expectations have changed only marginally. Expectations for short-term interest rates in three months (twelve months) remain at 3.7 points (2.8 points). The respondents’ high degree of uncertainty regarding the ECB’s future interest rate decisions is reflected in the ranges of expectations, which stand at 0.9 and 2.4 percentage points (also unchanged compared to July). These levels are relatively high for such a short forecast horizon.

Divergence among experts over growth expectations for Germany

Germany’s quarterly growth figures show an increase of 0.2 per cent in the first quarter of 2024 and a decrease of 0.1 per cent in the second quarter of 2024. The decline in GDP growth in the second quarter has raised concerns that Germany is on the brink of a recession. However, growth expectations for 2024 have changed only slightly compared to the previous month. Experts still expect GDP to grow by 0.2 per cent in 2024. There has been a notable shift in the degree of uncertainty among the experts, with the range of expectations increasing by 0.9 percentage points to 1.5 percentage points. This indicates a significantly higher level of disagreement among experts regarding the growth outlook for the current year. The growth forecast for 2025 has been lowered by 0.1 percentage points to 1.0 per cent, with the range remaining unchanged at 1.4 percentage points.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is extracted from these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current forecasts for the GDP, the expenditure breakdown, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate differentials (IDRs). The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutions.