Stagnation Expected for the German Economy

Business Cycle Tableaus by ZEW and Börsen-ZeitungGerman Economy Lags Behind the Eurozone

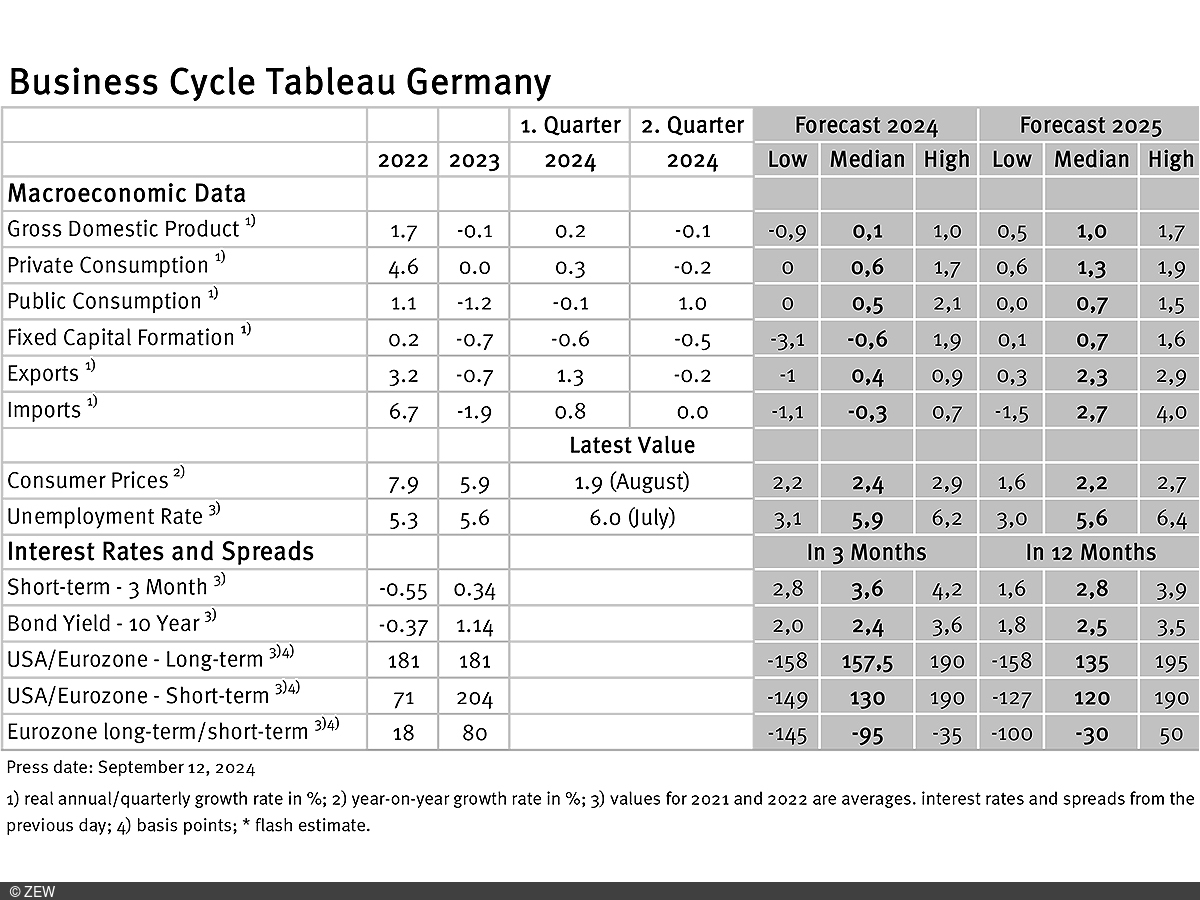

Business cycle experts expect the German economy to stagnate in 2024 after real GDP contracted in the second quarter, with declining investment identified as the main cause. In contrast, moderate growth is expected for the eurozone, with the German economy lagging behind the eurozone average in both current and projected growth forecasts. On a positive note, inflation in Germany has fallen below the ECB’s target, while inflation expectations for the coming years remain unchanged. Short-term interest rate expectations have slightly decreased, but uncertainty remains high due to unclear communication from the ECB. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

Germany’s real GDP shrank by 0.1 per cent in the second quarter of 2024 compared to the previous quarter, following a 0.2 per cent growth in the first quarter of 2024. One key factor behind the decline was fixed investment, which fell by 0.5 per cent in the second quarter. A recent study on behalf of the Federation of German Industries (BDI) took a closer look at the underlying reasons for the poor performance of the German economy. Reflecting these negative signals from the real economy, there is growing pessimism about short-term growth expectations. Experts have lowered their 2024 growth forecast by 0.1 percentage points to just 0.1 per cent, effectively signalling stagnation for the year. Additionally, the range of individual growth forecasts has widened by 0.4 percentage points to 1.9 percentage points, indicating increasing uncertainty. For 2025, growth is still expected to be 1.0 per cent, while the range of expectations has narrowed by 0.2 percentage points to 1.4 percentage points. Notably, there is greater consensus among experts about next year’s growth outlook compared to 2024.

German economy falls behind eurozone average

The eurozone’s quarterly growth rates were 0.3 per cent in the first quarter of 2024 and 0.2 per cent in the second quarter of 2024. Growth expectations for the entire year remain at 0.8 per cent, while a growth rate of 1.4 per cent is forecast for 2025, both unchanged from the previous month. A comparison of the current figures makes it clear that the German economy continues to fall behind the rest of the eurozone in terms of both actual growth and growth expectations.

Declining inflation rates in Germany and the eurozone

There is positive news regarding inflation trends in both Germany and the eurozone. In August, inflation rates stood at 1.9 per cent in Germany and 2.2 per cent in the eurozone, both down 0.4 percentage points from July. For the first time in a long while, Germany’s inflation rate has fallen below the ECB’s target. Despite these notable shifts in actual inflation rates, they have yet to be reflected in experts’ inflation expectations. As was the case last month, inflation rates of 2.4 per cent are still expected for both Germany and the eurozone for the whole of 2024. For 2025, inflation is forecast at 2.2 per cent for both regions. While Germany’s inflation expectations remain unchanged, the forecast for the eurozone has increased slightly by 0.1 percentage points.

Slight decline in short-term interest rate expectations

In line with the unchanged inflation expectations, short-term interest rate forecasts have also seen only minor adjustments. Expectations for short-term interest rates over the next three months have dropped by 0.1 percentage points compared to last month’s survey, now standing at 3.6 points. The range of interest rate forecasts has increased significantly, by 0.5 percentage points, to 1.4 percentage points. This development aligns with the ECB’s unclear communication regarding further rate cuts this year. The interest rate expectation for 2025 remains unchanged at 2.8 points, with several rate cuts still expected for the coming year.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is extracted from these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current forecasts for the GDP, the expenditure breakdown, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate differentials (IDRs). The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutions.