Experts Expect Low GDP Growth despite ECB Interest Rate Cuts

Business Cycle Tableaus by ZEW and Börsen-ZeitungUncertainty Characterises Expectations for Germany and the Eurozone

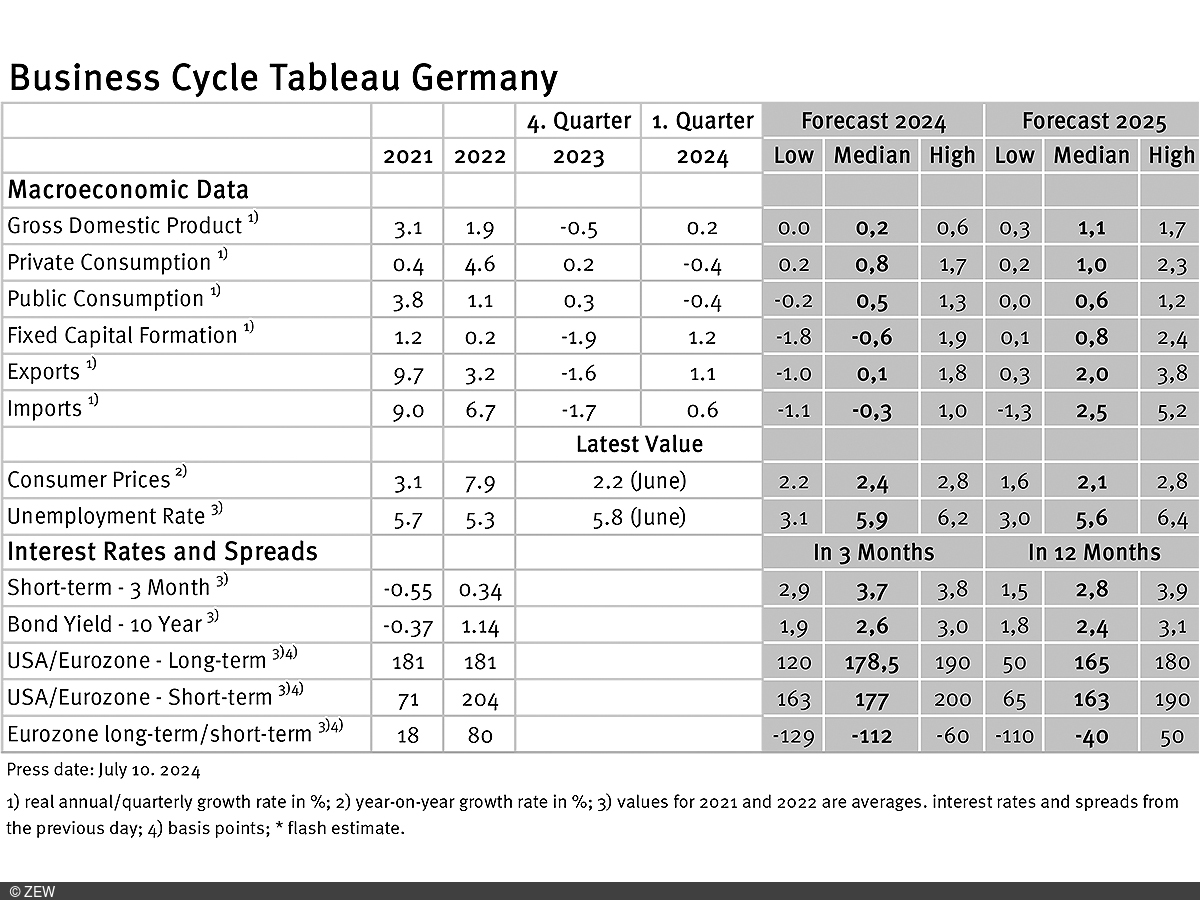

After modest GDP growth in Germany in the first quarter of 2024, economic experts expect growth to remain subdued. The ECB’s interest rate cut in June 2024 did not lead to a more optimistic GDP forecast. In 2025, moderate growth is still expected in Germany. Experts are presumably more pessimistic about further interest rate cuts due to an increase in the inflation rate in May and the associated uncertainties regarding the ECB’s monetary policy decisions. Inflation rates are expected to stabilise in 2024, while the forecast for 2025 remains unchanged. Growth expectations for the eurozone have improved slightly for 2024, while moderate growth is still anticipated in 2025. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

Real GDP in Germany grew by 0.2 per cent in the first quarter of 2024 when compared to the fourth quarter of 2023. At the same time, the European Central Bank (ECB) decided to cut interest rates for the first time in June 2024, which was generally seen as an indication of easing inflationary pressure in the eurozone. However, this favourable outlook both for Germany and abroad is not currently reflected in the experts’ expectations. For 2024, they continue to predict a 0.2 per cent increase in German GDP. In contrast, the range of individual growth prospects fell by 0.3 percentage points to a value of 0.6 percentage points, which indicates a comparatively high level of agreement among the respondents regarding the forecast horizon. At 1.1 per cent, the 2025 growth forecast is 0.1 percentage points below the previous month’s value but still above the expectation for 2024.

Disagreement among experts regarding interest rate decisions

The development of the growth forecasts described above could be linked to the experts’ monetary policy expectations. Expectations for short-term interest rates over a three-month period have risen by 0.3 percentage points to a new value of 3.7 points since June. Thus, experts appear to have become somewhat more pessimistic about further interest rate hikes in the current year. This could be linked to the rise in the eurozone’s inflation rate that was observed in May, which some experts may have interpreted as an indication that inflationary pressure has not yet been conquered. This would be consistent with the fact that the ECB intends to make further interest rate cuts primarily on the basis of data. Disagreement among the experts is also reflected in the relatively wide range of expectations of 0.9 percentage points. It is therefore conceivable that a high level of uncertainty about future inflation dynamics and the associated monetary policy decisions of the ECB has contributed to only minor adjustments in growth expectations for Germany. By contrast, the interest rate expectation for 2025 remains unchanged at 2.8 points. Further interest rate cuts are therefore forecast for the coming year.

Inflation rate remains constant

In view of the obvious interplay between inflation, interest rate and growth expectations, it is worth taking a look at the current inflation rates. In June, inflation rates stood at 2.2 per cent for Germany (down 0.2 percentage points from May) and 2.5 per cent for the eurozone (down 0.1 percentage points from May). This means that the upward trend in inflation rates observed in May has reversed after just one month. As in the previous month, inflation rates of 2.4 per cent are expected for both Germany and the eurozone for 2024 as a whole. The projected inflation rates for 2025 have also not changed and are set at 2.1 per cent for both Germany and the eurozone. The small changes in inflation expectations thus confirm the impression that the rise in inflation in May is regarded by many experts as an outlier.

Growth expectations for the eurozone rise only slightly

Quarterly growth in the eurozone was registered as 0.1 per cent in the fourth quarter of 2023 and 0.3 per cent in the first quarter of 2024. There are thus increasing signs of a slow but steady economic recovery. Growth expectations for 2024 have risen by 0.1 percentage points to a new figure of 0.8 per cent. However, economic growth expectations for 2025 remain stable at 1.5 per cent. The slight changes in growth prospects for the eurozone are presumably also related to the uncertainty among experts regarding the further development of inflation rates and the associated interest rate decisions.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is extracted from these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current forecasts for the GDP, the expenditure breakdown, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate differentials (IDRs). The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutions.